Self-Employed Retirement Plans

According to a Bloomberg report1 from October 2022, more Americans are self-employed than at any time since the 2008 Financial Crisis. This trend has continued steadily over the last decade as more workers leave traditional jobs in search of opportunities that offer more freedom and control. What these individuals may not realize is that there are numerous self-employed retirement plan options that can replace the 401k offered by traditional employers. Here are a few, with some pros and cons:

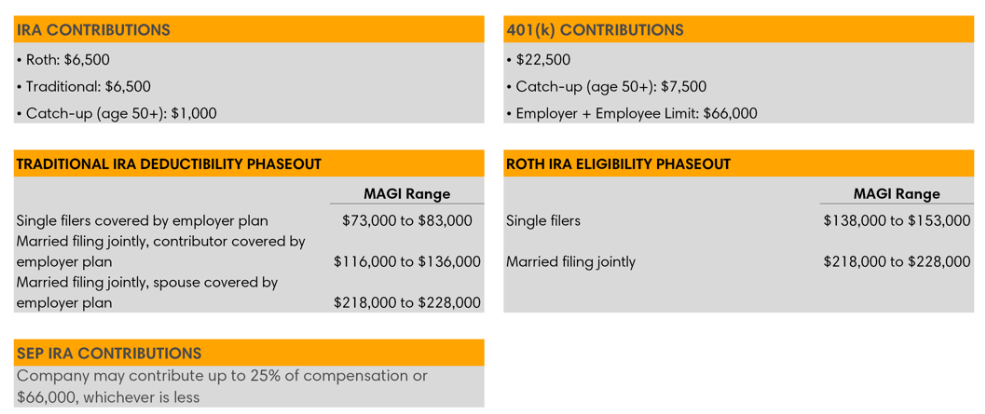

1. Traditional or Roth IRA: These are ideal for someone just starting out since the contribution limits are lower. They’re easy to set up and are available to anyone under the income limits.

2. SEP IRA: These are ideal for more established businesses, as the contribution limits are much higher. However, the contribution limits will vary based on your actual income.

3. Solo 401k: These have similar higher contribution limits as the SEP IRA, but offer additional advantages: Catch-up contributions, Roth Contributions, and loan provisions. However, they can be an administrative burden, as you may have to hire a Third-Party Administrator (TPA) and file annual paperwork with the IRS.

Options 2 and 3 can really accelerate your retirement plan due to contribution limits being much higher than that of a traditional 401k. If you’re self-employed and need advice on which one of these may be your best option, please contact us. We’d love to help!

The Internal Revenue Service has set the following retirement plan contribution limit for 2023 tax year.