The Importance of Withdrawal Rates in Retirement

Deciding how much money to withdraw from your portfolio during retirement is a deeply personal decision. Some people want to maintain their current lifestyle, others want to go above and beyond, and a few even scale back. This decision is usually based on several factors, including health, desire to travel, philanthropy, and hobbies. However, the one factor that most people overlook is whether their current withdrawal rate will allow them to not outlive their retirement savings.

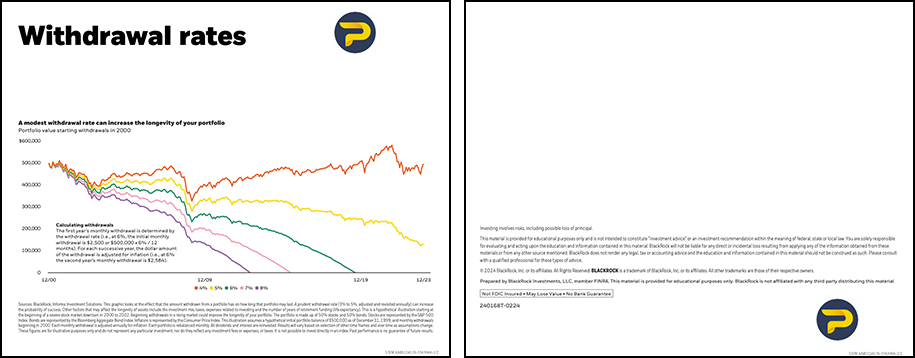

Looking at the attached PDF is telling because it analyzes different withdrawal rates from 2000-2023, which included the 00-02 tech bubble, 08-09 financial crisis, COVID, and the 2022 inflationary bear market. Had someone withdrawn 6%, 7% or 8% of their portfolio value over that time would have run out of money within 20 years. Had that same person withdrawn just 4% or 5% during that same time would have been in a much better situation to continue that lifestyle.

The reason is simple: Withdrawing too much money during periods of market stress means that you’re pulling the same amount of money from a smaller portfolio value. Being flexible during periods of market stress is of utmost importance! Having an updated financial plan is equally important, as this can help project your future portfolio value based on current market situations. If you’re in need of an updated financial plan, please contact us for a free consultation.

Click Here to Download